- Cliff Equity

- Posts

- 📈 Semble Snags £11.6M: Boosting UK Healthcare Tech!

📈 Semble Snags £11.6M: Boosting UK Healthcare Tech!

Deep Tech Gets Deeper with €1.4B Boost

This is Cliff Equity, the UK’s business newsletter that keeps you informed on what’s important in tech, business and finance in less than 5 minutes

In today’s stories:

Semble Snags £11.6M: Boosting UK Healthcare Tech!

Deep Tech Gets Deeper with €1.4B Boost

1,425 Jobs Vanish as Santander Automates!

The summary: With fresh funding and a mission to ditch outdated tech, Semble’s all-in-one clinical system is set to supercharge healthcare efficiency across the UK and France, giving medical pros more time for patient care and bringing healthcare firmly into the digital age.

The details:

Series B boost: London’s Semble just clinched a tidy $15 million in Series B funding, led by Mercia Ventures, with some backup from Octopus Ventures, Smedvig Ventures, and Triple Point, bringing their total to $27 million.

Streamlining healthcare: Semble’s all-in-one clinical system, founded by Christoph Lippuner and Mikael Landau, aims to banish outdated tech from healthcare by automating admin work, allowing seamless data exchange, and supporting over 10,000 professionals across 70+ specialties.

Expansion mode: Fresh funds mean a stronger UK presence and a solid push into France, where Semble recently launched, with a focus on AI and automation to keep clinicians laser-focused on patient care.

Industry endorsement: Mercia Ventures calls Semble a game-changer, tackling healthcare’s outdated IT with an agile, transformative system to make healthcare more connected, efficient, and—ultimately—patient-centred.

Why it matters: Semble’s success is a win for healthcare professionals bogged down by clunky, outdated tech—it’s high time they got a system that actually supports patient care rather than stifling it. With fresh capital in hand, Semble can extend its reach across the UK and France, offering medical pros a digital lifeline to lighten their load. And with AI and automation leading the charge, they’re set to give healthcare a serious shot in the arm—making patients the real winners here.

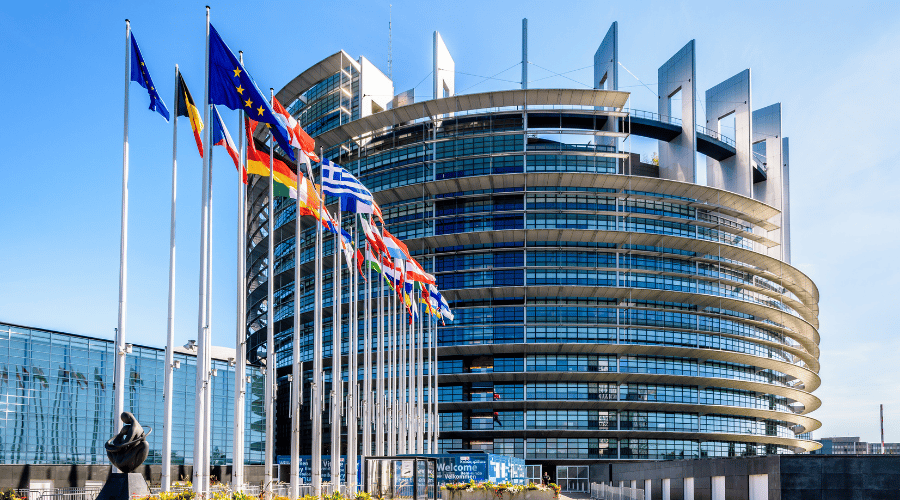

The summary: With a record €1.4 billion funding boost, the European Innovation Council is powering up Europe’s tech scene, backing deep tech breakthroughs and scaling up homegrown startups to take on the world.

The details:

The European Innovation Council (EIC) is set to unleash €1.4 billion (£1.16 billion) in 2025, turbocharging deep tech research and high-potential start-ups across Europe.

A shiny new STEP Scale-up scheme kicks off with €300 million (£249 million), aiming to provide hefty equity injections of €10-€30 million (£8.3-£25 million) for strategic tech scale-ups, with plans to triple the budget by 2027.

The EIC’s 2025 programme will see €994 million (£826 million) earmarked for early-stage R&D, practical applications, and critical support for innovative SMEs—essentially fuelling the future in areas like AI, biotech, and clean tech.

EIC has earned bragging rights as Europe’s deep tech champion, already backing over 630 companies and 450 research projects and establishing the continent’s largest deep tech co-investment fund with €1 billion (£830 million).

Why it matters: The European Innovation Council’s ramped-up funding is a lifeline for Europe's tech startups, giving them the resources to scale globally and compete with Silicon Valley giants. By plugging crucial funding gaps, the STEP Scale-up scheme is setting the stage for European breakthroughs in clean tech, biotech, and AI to take centre stage. And with £830 million already invested in deep tech, the EIC isn’t just talking big – it’s putting its money where its mouth is to make Europe a powerhouse of innovation.

The summary: Santander's job cuts may be a sign of its efficient approach, but with profits soaring and a new court ruling shaking up car loan commissions, it's a lively time for the bank and its customers alike!

The details:

Santander Shrinks the Workforce: Santander UK will say goodbye to 1,425 staff by year-end, a move to cut costs as it automates more of its operations. A swift slice out of its 21,812-strong UK team.

Profit Surge Amidst Legal Drama: Santander Group celebrates a robust 11% profit boost, but UK operations hit pause on financial results to digest a court ruling over dealer commissions on car loans.

Court Ruling Shakes Up Car Finance: A ruling now requires lenders to be fully transparent about commissions on car loans, and Santander isn’t thrilled, calling it a "higher bar" than anticipated.

Ripple Effects Expected: Santander, like Lloyds, is bracing for potential financial impact and a wave of consumer complaints, adding a bit of extra spice to its UK operations this year.

Why it matters: Santander’s job cuts and profit surge reveal how big banks are tightening their belts while still cashing in, making it clear that efficiency, not empathy, is the priority. The court’s new transparency ruling on car loan commissions sets a precedent that could spell costly changes for lenders—and a headache for banks like Santander, already grappling with complaints. For UK customers and car dealers alike, it’s a wake-up call: know the fine print, or pay the price!

Trending stories

How would you rate today's edition: |